Hustler Words – Four co-founders of Bending Spoons have recently ascended into the billionaire ranks, marking a significant milestone for the Milan-based tech firm. CEO Luca Ferrari’s stake is now estimated at $1.4 billion, while co-founders Matteo Danieli, Luca Querella, and Francesco Patarnello each hold stakes valued at $1.3 billion, according to Forbes’ analysis of shareholder data from the Italian Business Register.

These valuations follow Bending Spoons’ recent funding round, which included $270 million from investors such as T. Rowe Price and previous backers Baillie Gifford, Cox Enterprises, Durable Capital Partners, and Fidelity. Additionally, a $440 million secondary share sale by existing shareholders took place. It remains unclear whether any of the co-founders participated in the secondary transaction. Bending Spoons has chosen not to comment on the co-founders’ individual stakes.

Despite its memorable name, Bending Spoons has maintained a relatively low profile. The company, which has been operating for 12 years, typically gains attention when it adds another well-known brand to its expanding portfolio. Most recently, this occurred with its agreement to acquire AOL for an undisclosed sum.

Related Post

However, Bending Spoons is not a typical private equity firm or purely a financial investment vehicle. Its primary focus is on acquiring underperforming yet popular tech brands and transforming them to better serve millions of users.

The company often makes headlines when it restructures these acquired entities, frequently through substantial layoffs, or implements controversial changes to beloved products, as seen with Evernote and WeTransfer.

Despite this, Bending Spoons itself remains largely unknown, even though its portfolio of products has served over a billion people, with more than 300 million monthly active users and 10 million paying customers. Here’s what you need to know about the company reshaping some of the internet’s most recognizable brands.

What is Bending Spoons?

Bending Spoons describes itself as a company that acquires and transforms digital businesses. With a workforce of 400 to 500 employees, known as "Spooners," its main objective is to improve existing products and services.

However, this wasn’t always the company’s focus. Initially, Bending Spoons’ founders attempted to develop their own apps and products before shifting their strategy.

The lesser-known origin story reveals that Bending Spoons emerged from the remnants of Evertale, a Copenhagen-based startup that participated in Disrupt SF 2011’s Startup Alley and secured seed funding for its photo-sharing app, Wink.

Evertale eventually failed, allowing investors to exit. However, its founders and a few employees continued to collaborate, initially working on in-house apps. Eventually, the team made its first acquisition, followed by numerous others, according to CEO and co-founder Luca Ferrari in an interview on the 20VC podcast.

In 2020, Bending Spoons made an exception by creating and donating Immuni, Italy’s official COVID-19 contact tracing app. However, aside from this, the company has primarily focused on refining its formula: identifying popular products with potential for improvement, acquiring them from owners who have reached their limits.

Following an acquisition, Bending Spoons actively implements changes to the product’s user experience and features, as well as the underlying technology, monetization strategy (including pricing), and team organization (including headcount).

While this emphasis on efficiency and revenue aligns with private equity strategies, Bending Spoons asserts a key difference: it "aims to hold forever and has never sold an acquired business." The company is building a live portfolio, not simply collecting internet relics or overseeing a tech graveyard.

It’s important to note that Bending Spoons’ acquisition targets have not necessarily been failing businesses. Many still possessed substantial user bases and revenue. However, they tended to be stagnant, neglected, or had owners seeking an exit. Let’s recap these key deals and examine their aftermath.

What Companies Has Bending Spoons Acquired?

While Bending Spoons acquired several companies between 2014 and 2021, including AI photo enhancer Remini, its most notable acquisitions have occurred more recently.

In 2022, it acquired Filmic, known for its popular video and photo editing apps, and laid off the entire staff in December 2023.

In a deal also announced in 2022 and finalized in early 2023, Bending Spoons acquired Evernote, the note-taking app that had reportedly reached a $1 billion valuation before encountering difficulties. Layoffs followed the acquisition, as well as cuts to Evernote’s free offering.

The first half of 2024 was particularly active, with the acquisition of Meetup, app maker Mosaic Group, and Hopin’s StreamYard.

In July 2024, it went on to acquire the publishing platform Issuu and the file transfer service WeTransfer, where it later cut staff and made changes to its free plan, introducing stricter limits. Later in the year, Bending Spoons announced it would spend $233 million on an all-cash take-private deal to acquire video platform Brightcove.

The acquisitions have continued apace in 2025, with acquisitions that include the outdoors route planner Komoot and management software maker Harvest.

Bending Spoons also announced its intention to acquire Vimeo in a $1.38 billion all-cash deal, and even more recently, to acquire AOL from Yahoo. (Disclosure: both AOL and Yahoo are former owners of hustlerwords.com, in which Yahoo retains a small interest.)

According to Bending Spoons, the acquisitions of AOL and Vimeo are expected to close by the end of the year, subject to standard closing conditions and regulatory approvals, including, in the case of Vimeo, approval by its stockholders.

How Much is Bending Spoons Worth?

As of the end of October 2025, Bending Spoons is one of Europe’s rare tech decacorns (companies valued at more than $10 billion). The startup last raised at a $2.8 billion valuation in 2024, making its newest latest round a significant step up.

Though long bootstrapped, Bending Spoons had previously raised equity financing several times, including in September 2022 and early 2024. It also has VIPs on its cap table, including tennis and entertainment stars Andre Agassi and Bradley Cooper; tech industry bigs Eric Schmidt, Mike Krieger, and Xavier Niel; and performers The Weeknd, The Chainsmokers, and Maluma.

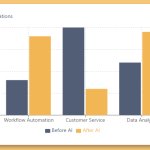

According to Bending Spoons, its new funding will support future acquisitions and investment in its proprietary technology and AI capabilities. This comes in addition to the $2.8 billion in debt financing the company disclosed as it announced its intention to acquire AOL, debt that will fund the AOL deal and future acquisitions.

What’s Next?

Bending Spoons says it intends to continue pursuing new acquisitions that expand its portfolio of consumer and enterprise digital products, and it now has funding to afford more prominent targets going forward.

AOL and Vimeo already carry far more name recognition than earlier targets, even if deal terms remain undisclosed. The properties also have some reach. In announcing the AOL deal, Bending Spoons claimed that AOL remains one of the top 10 most-used email providers in the world, with 8 million daily active users and 30 million monthly active users. (Not long before acquiring AOL, Bending Spoons was also rumored to be eyeing app maker Elysium and Typeform, the Barcelona-based SaaS company known for its form creation tools.)

Presumably to support its continued efforts to acquire companies, it also has openings across various roles, with new hires initially working from its Milan headquarters before gaining the option to work from offices in London, Madrid, and Warsaw, or remotely.

In fact, despite warning candidates that Bending Spoons is a "demanding environment," the company has said it already received more than 600,000 job applications in 2025, a figure that will likely climb as its recent deals generate additional attention.

Leave a Comment