Hustler Words – Venture capitalists are increasingly drawn to the idea of leveraging artificial intelligence to revolutionize traditionally labor-intensive service businesses, aiming for software-like profit margins. This strategy involves acquiring established professional services firms, implementing AI to automate tasks, and then using the increased cash flow to acquire more companies in a roll-up fashion. However, emerging challenges suggest this transformation may be more complex than initially anticipated.

General Catalyst (GC) is at the forefront of this trend, allocating $1.5 billion from its latest fund to a "creation" strategy. This approach focuses on incubating AI-native software companies within specific sectors, then using these companies as acquisition vehicles to buy established firms and their customer base. GC has already invested in seven industries, ranging from legal services to IT management, and plans to expand to approximately 20 sectors.

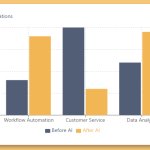

Marc Bhargava, who spearheads GC’s efforts, highlighted the potential in a recent interview with hustlerwords.com, noting the vast difference in market size between services ($16 trillion globally) and software ($1 trillion globally). The allure of software investing lies in its high margins, driven by minimal marginal costs and substantial marginal revenue as it scales. Automating service businesses, potentially tackling 30% to 50% of tasks with AI (and up to 70% in call centers), makes the financial prospects very appealing.

Related Post

GC’s portfolio company, Titan MSP, exemplifies this strategy. With $74 million in funding, Titan developed AI tools for managed service providers and subsequently acquired RFA, a well-known IT services firm. Pilot programs demonstrated Titan’s ability to automate 38% of typical MSP tasks, paving the way for further acquisitions. Similarly, Eudia, another GC-incubated company, focuses on in-house legal departments, offering fixed-fee legal services powered by AI and recently acquired Johnson Hanna to broaden its reach. GC aims to at least double the EBITDA margin of acquired companies.

Mayfield is also investing in this space, allocating $100 million for "AI teammates," including Gruve, an IT consulting startup that significantly increased revenue and achieved high gross margins after acquiring a security consulting company. Elad Gil has been pursuing a similar strategy for three years, backing companies that acquire and transform mature businesses with AI.

However, a recent study by Stanford Social Media Lab and BetterUp Labs reveals a potential pitfall: "workslop," or AI-generated work that lacks substance and creates additional work for employees. The study found that 40% of employees are burdened with this issue, spending an average of nearly two hours per instance to decipher, correct, or rework the AI-generated output. This "invisible tax" can cost organizations significant productivity and money.

Bhargava counters the notion that AI is overhyped, arguing that implementation failures highlight the difficulty and opportunity in applying AI technology to these businesses. He emphasizes the need for specialized AI engineers who understand the nuances of different models and how to integrate them effectively into software.

Despite these challenges, the profitability of acquired businesses, a departure from traditional VC models, and the continuous improvement of AI technology suggest that this trend is likely to continue, with more industries becoming targets for AI-driven transformation.

Leave a Comment