Hustler Words – Super.money, the fintech platform born from Walmart-owned Flipkart, is making waves with a strategic partnership with Juspay, a payment infrastructure firm navigating turbulent waters. This alliance aims to fuel Super.money’s expansion into the direct-to-consumer (D2C) checkout space, with ambitious goals of reaching $100 million in annual revenue by 2026.

The collaboration arrives at a pivotal moment for Juspay, which has been striving to regain its footing after facing headwinds from major payment companies earlier this year. This dispute complicated its fundraising efforts.

Super.money recently unveiled its D2C checkout solution, Super.money Breeze, promising merchants a streamlined, one-click checkout experience. While the company remained tight-lipped about its technology partners, sources at hustlerwords.com have confirmed that Juspay is the engine powering the payments infrastructure behind this new offering.

Related Post

This move could significantly broaden Super.money’s reach, exposing it to new customers and enhancing its visibility among D2C brands. While Super.money already benefits from Flipkart’s extensive distribution network, the checkout product signifies a clear push towards establishing a distinct identity within the broader e-commerce landscape.

For Juspay, the partnership represents a crucial opportunity to rebuild trust and recapture market share among Indian merchants. Earlier this year, several payment gateways, including Razorpay and Cashfree Payments, shifted away from Juspay, prompting merchants to adopt their in-house payment processing tools. This fallout impacted Juspay’s fundraising efforts, with its most recent round falling short of initial expectations.

Juspay was once a preferred backend partner for payment aggregators, known for its payment routing platform that minimized transaction failures. The company boasts Amazon as a long-standing client and secured a payment aggregator license from the Reserve Bank of India last year. However, the intensifying competition in India’s digital payments arena has led players like Razorpay, Cashfree, and Flipkart’s own PhonePe to reduce their reliance on third-party providers, favoring direct relationships with merchants.

Super.money’s decision to partner with Juspay bucks the trend of payment players building and controlling their own infrastructure. However, for a young fintech still expanding its reach beyond Flipkart, this move offers a shortcut to D2C integrations without the need to build full-stack payment capabilities from scratch. It also signals Super.money’s intention to delve deeper into consumer transactions and increase payments through its platform.

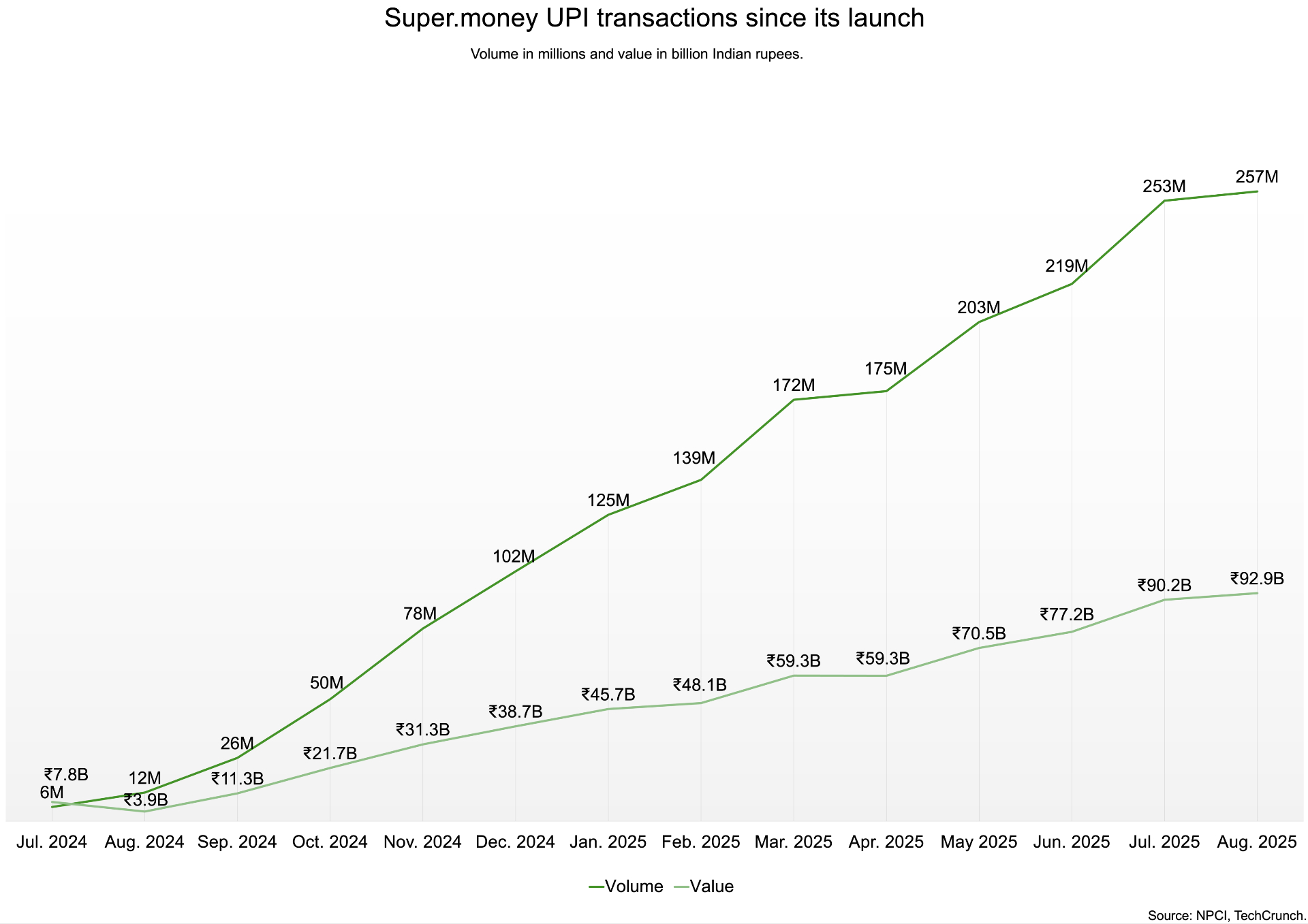

Launched in June 2024, Super.money has rapidly ascended to become one of India’s top five UPI apps by transaction volume. The app has consistently processed over 200 million transactions per month, according to data from the National Payments Corporation of India.

In recent months, Super.money has surpassed established players like Axis Bank, ICICI Bank, Amazon Pay, and CRED in the UPI rankings, a remarkable achievement for a relatively new app.

Super.money has also emerged as a leading issuer of secured credit cards in India, holding a 10% market share. These cards require customers to provide a deposit and are currently issued in partnership with Utkarsh Small Finance Bank. The company is actively seeking to expand this business and is in discussions with a private sector lender to scale distribution.

To date, Super.money has issued approximately 300,000 secured cards and is adding around 50,000 new cards each month.

The secured card business is central to Super.money’s monetization strategy, enabling it to transition users from low-margin UPI payments to more profitable financial products. While the company doesn’t charge for UPI transactions, it leverages that volume to onboard customers and cross-sell higher-yield offerings such as credit cards and consumer loans.

Unlike many other UPI-focused fintechs, Super.money has maintained a low burn rate by leveraging Flipkart’s distribution network rather than relying on heavy marketing. The company operates with a lean team of around 130 to 150 people to serve its user base of over 80 million users.

For Flipkart, Super.money represents a renewed focus on fintech after spinning out PhonePe in 2023. While PhonePe has since become a dominant force in India’s UPI landscape, it now operates independently under Walmart’s umbrella. Super.money, in contrast, remains closely integrated with Flipkart and appears focused on monetizing financial services directly within and beyond the e-commerce ecosystem.

Flipkart has invested $50 million in Super.money to launch its business, led by Prakash Sikaria, who previously served as Flipkart’s chief experience officer for customer growth, marketing, ads, and new initiatives.

Super.money is now looking to raise an external round, aiming for a valuation of around $1 billion sometime next year.

The company is on track to close 2025 with around $30 million in annual recurring revenue and aims to more than triple that figure in 2026, driven by growth in its secured credit card business, personal lending, and the recently launched D2C checkout product.

However, Super.money is still in the early stages of monetization and will likely face intense competition from established players like PhonePe, Google Pay, and Razorpay, all of whom are building or defending their own payments infrastructure. Its ability to convert UPI scale into sustainable revenue, particularly through lending and checkout infrastructure, will determine whether it can become Flipkart’s second major fintech success or face the same ecosystem pressures currently weighing on its partner, Juspay.

Leave a Comment