Hustler Words – India is embarking on a significant transformation of its innovation landscape, specifically targeting the burgeoning deep tech sector. Recognizing the inherently longer gestation periods required for groundbreaking advancements in fields like space technology, semiconductors, and biotechnology, the Indian government has revised its startup policies and committed substantial public capital. This strategic pivot aims to cultivate a robust ecosystem capable of nurturing these complex ventures from foundational research to commercial viability.

This week, New Delhi unveiled updated regulations that extend the operational window for deep tech companies to qualify as startups from a mere 10 years to an unprecedented 20 years. Concurrently, the revenue ceiling for accessing critical startup-specific tax incentives, grants, and regulatory benefits has been tripled, escalating from ₹1 billion (approximately $11.04 million) to ₹3 billion (around $33.12 million). These adjustments are meticulously designed to synchronize policy frameworks with the extended development cycles characteristic of science and engineering-intensive businesses, which often require years of research and prototyping before market entry.

The policy modifications are integral to India’s broader vision of fostering a long-horizon deep tech environment. This vision is underpinned by a dual strategy: regulatory reform coupled with significant public financial backing. A cornerstone of this initiative is the ₹1 trillion (approximately $11 billion) Research, Development and Innovation (RDI) Fund, announced last year. This fund is specifically earmarked to provide "patient financing" – capital that tolerates longer payback periods – for companies driven by scientific discovery and intensive R&D. Complementing this governmental push, a powerful consortium of U.S. and Indian venture capital firms has launched the India Deep Tech Alliance, a private investor coalition exceeding $1 billion, featuring prominent names such as Accel, Blume Ventures, Celesta Capital, Premji Invest, Ideaspring Capital, Qualcomm Ventures, and Kalaari Capital, with chipmaking giant Nvidia serving as a strategic advisor.

Related Post

For founders navigating the intricate world of deep tech, these reforms promise to alleviate what many perceived as artificial constraints. Vishesh Rajaram, founding partner at Speciale Invest, an Indian deep tech venture capital firm, highlighted how the previous framework often risked stripping companies of their startup status prematurely, creating a "false failure signal" that misjudged science-led ventures based on unsuitable policy timelines. "By formally recognizing deep tech as distinct, the policy significantly reduces friction in critical areas like fundraising, securing follow-on capital, and engaging with state entities, which undeniably impacts a founder’s operational reality over time," Rajaram informed Hustler Words.

Despite these positive developments, investors acknowledge that access to sufficient capital remains a critical hurdle, particularly beyond the initial seed stages. "The most significant historical gap has been the depth of funding available at Series A and subsequent rounds, especially for capital-intensive deep tech enterprises," Rajaram added. This is precisely where the government’s RDI fund is strategically positioned to fill a vital complementary role. Arun Kumar, managing partner at Celesta Capital, elaborated, "The true value of the RDI framework lies in augmenting the funding pool for deep tech companies during their early and growth phases." By channeling public capital through established venture funds with investment horizons aligned with private capital, the fund aims to bridge chronic follow-on funding deficits without distorting the commercial criteria that guide private investment decisions.

Siddarth Pai, founding partner at 3one4 Capital and co-chair of regulatory affairs at the Indian Venture and Alternate Capital Association, noted that India’s new deep tech framework skillfully avoids a "graduation cliff." This phenomenon historically cut off support for companies precisely when they were poised for significant scaling. These policy changes coincide with the RDI fund’s operational ramp-up, with initial fund managers already identified and the selection process for venture and private equity managers actively underway, Pai confirmed. While private capital for deep tech already exists in India, particularly in sectors like biotech, Pai explained to Hustler Words that the RDI Fund is designed to serve as a nucleus, catalyzing greater overall capital formation. Uniquely, this vehicle is also structured to take direct equity positions and provide credit and grants directly to deep tech startups, unlike a traditional fund-of-funds model.

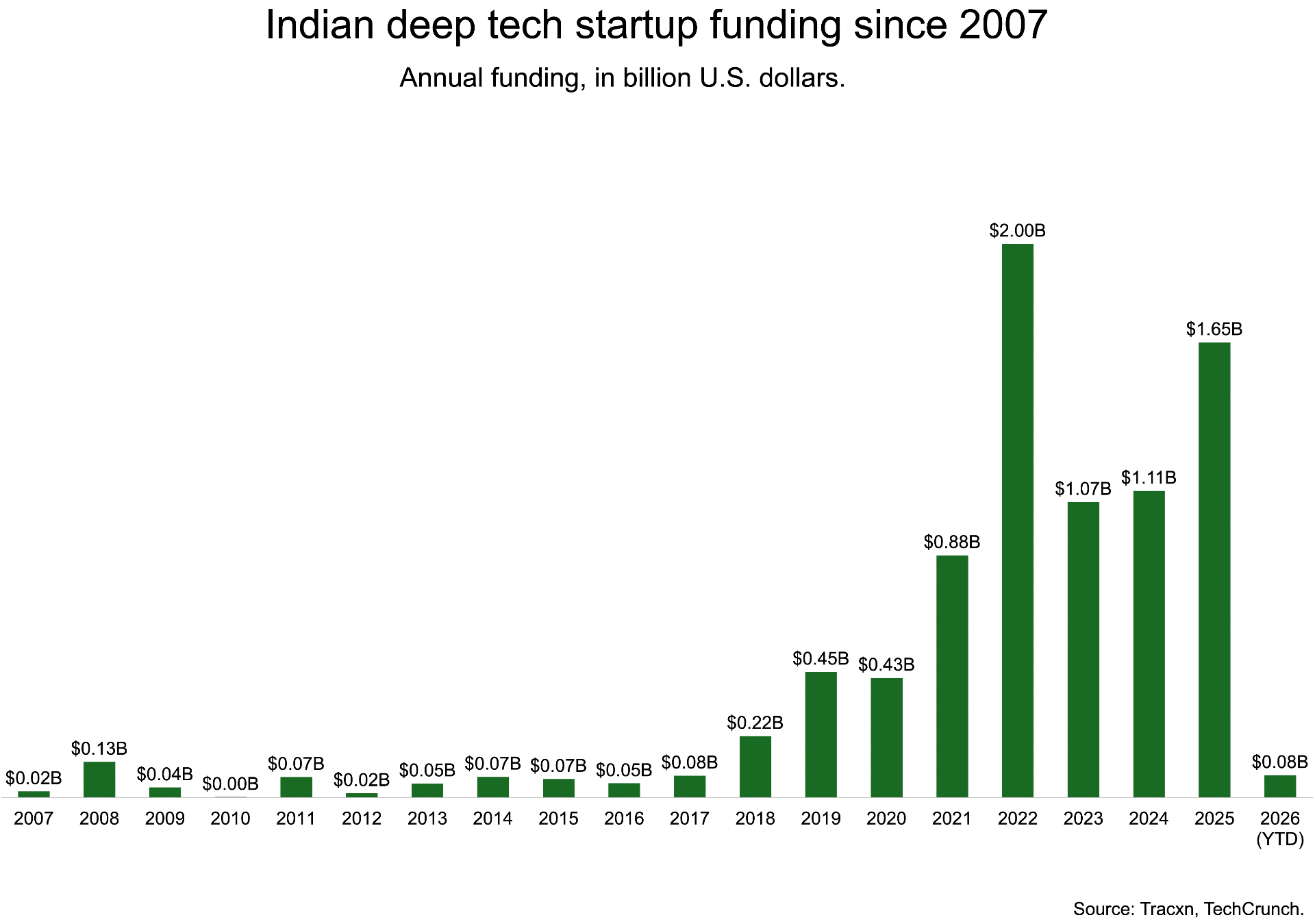

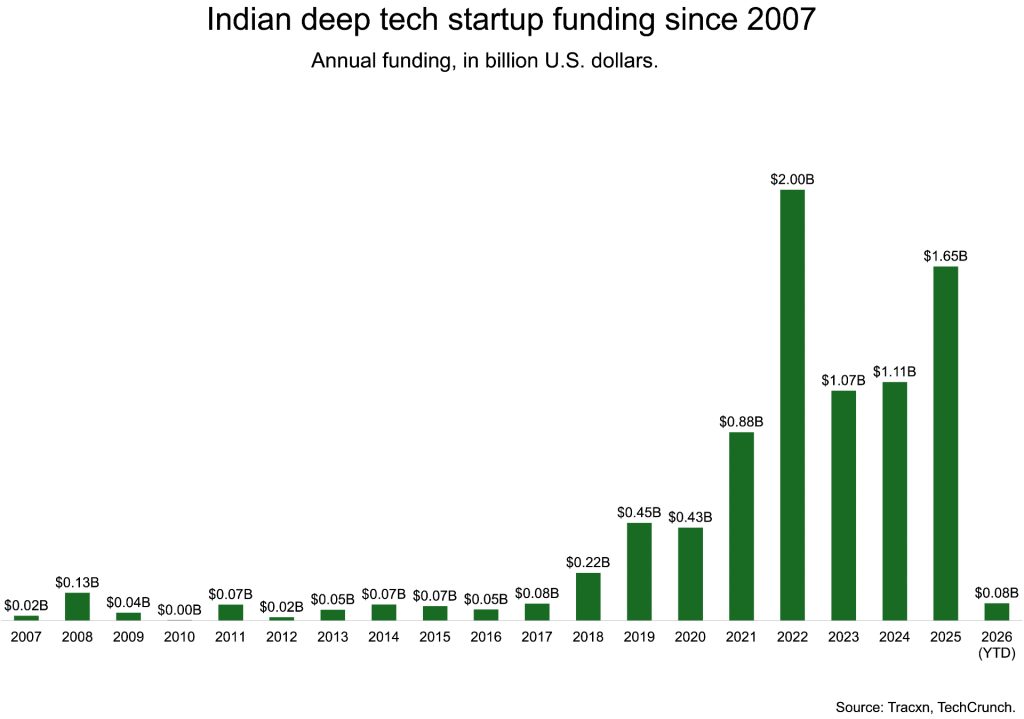

India’s deep tech funding landscape is showing promising signs of growth. Although India remains an emerging player compared to global giants, Indian deep tech startups have collectively raised $8.54 billion to date. Recent data indicates a robust resurgence, with $1.65 billion secured in 2025 – a sharp rebound from $1.1 billion in each of the preceding two years, though still below the $2 billion peak in 2022, according to Tracxn. This recovery signals burgeoning investor confidence, particularly in areas aligned with national strategic priorities such as advanced manufacturing, defense, climate technologies, and semiconductors. "Overall, the pickup in funding suggests a gradual shift towards longer-horizon investing," observed Neha Singh, co-founder of Tracxn.

To contextualize, U.S. deep tech startups attracted approximately $147 billion in 2025, a staggering 80 times the investment seen in India that year, while China accounted for roughly $81 billion, Tracxn data reveals. This disparity underscores the formidable challenge India faces in developing capital-intensive technologies, even with its abundant engineering talent. The hope is that these proactive governmental measures will significantly boost investor participation over the medium term.

For international investors, New Delhi’s framework overhaul is being interpreted as a powerful signal of long-term policy commitment rather than an immediate catalyst for dramatic shifts in capital allocation. "Deep tech companies typically operate on seven- to twelve-year horizons, so regulatory recognition that extends this lifecycle instills greater investor confidence that the policy environment will remain stable throughout their journey," commented Pratik Agarwal, a partner at Accel. While he acknowledged that the change wouldn’t instantaneously alter allocation models or entirely eliminate policy risk, it substantially increases investor comfort regarding India’s sustained focus on deep tech. "The change demonstrates India’s proactive approach in learning from the U.S. and Europe on how to construct patient frameworks for frontier innovation," Agarwal shared with Hustler Words.

An enduring question remains whether these extended runways will mitigate the tendency of Indian startups to relocate their headquarters overseas as they scale. Agarwal believes the strengthened domestic environment bolsters the case for building and remaining in India, though access to capital and customers will always be paramount. He added that over the past five years, India’s public markets have demonstrated an increasing appetite for venture-backed tech companies, making domestic listings a more credible and attractive option than in previous times. This, in turn, could alleviate some pressure on deep tech founders to incorporate abroad, even if access to procurement and late-stage capital will continue to influence where companies ultimately choose to scale.

For investors backing long-horizon technologies, the ultimate measure of success will be India’s ability to produce globally competitive outcomes. Arun Kumar of Celesta Capital articulated that the true signal of maturity for India’s deep tech ecosystem would be the emergence of a critical mass of Indian deep tech companies achieving sustained success on the world stage. "It would be fantastic to witness ten globally competitive deep tech companies from India achieve sustained success over the next decade," he concluded, setting a clear benchmark for assessing the nation’s progress.

Leave a Comment