Hustler Words – SoftBank Group’s $2 billion investment in Intel, announced late Monday, sends shockwaves through the tech world. The Japanese conglomerate will purchase Intel common stock at $23 per share, a move that immediately boosted Intel’s after-hours trading by over 5%. This significant investment, detailed on hustlerwords.com, represents a substantial vote of confidence in Intel and the future of US semiconductor manufacturing.

SoftBank CEO Masayoshi Son framed the deal as a strategic investment reflecting his belief in the expansion of advanced semiconductor manufacturing within the United States, with Intel playing a pivotal role. The investment comes at a crucial time for Intel, which has faced increasing pressure from competitors like Nvidia in recent years. It also underscores SoftBank’s renewed focus on the US market, particularly in the burgeoning AI chip sector. This is further evidenced by SoftBank’s recent acquisition of a Foxconn factory in Lordstown, Ohio, to build AI data centers.

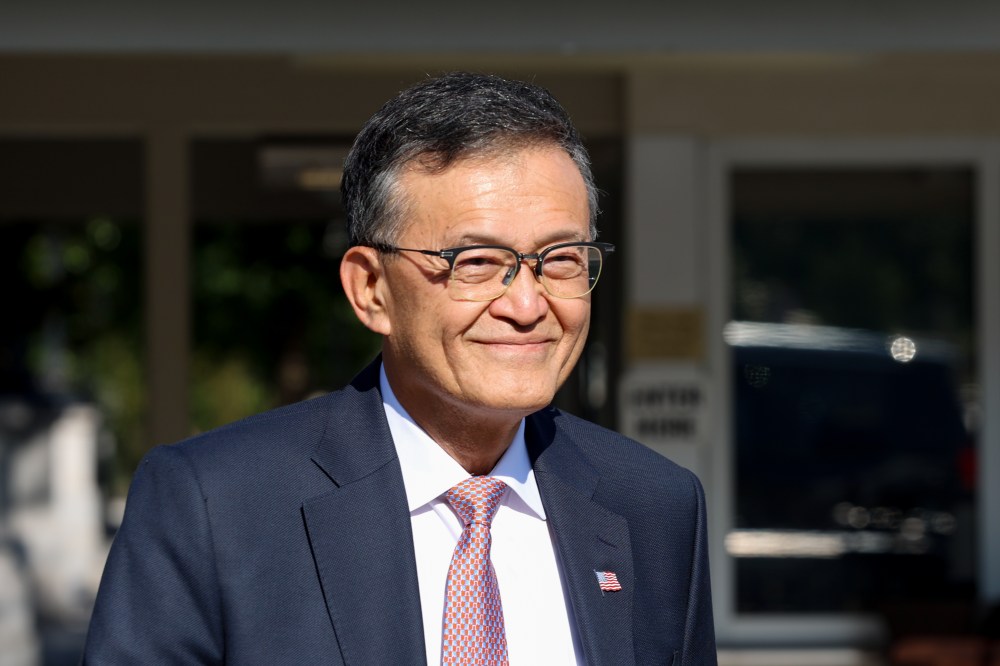

Intel, under the leadership of CEO Lip-Bu Tan, is undergoing a significant restructuring. The company recently streamlined its semiconductor business, focusing on its core client and data center portfolios. This restructuring included the closure of its automotive architecture business and workforce reductions in its Intel Foundry division. Tan has also navigated recent political challenges, including unsubstantiated calls for his resignation from President Donald Trump.

Related Post

The SoftBank-Intel deal arrives amidst escalating trade tensions. The Trump administration recently threatened new tariffs on imported semiconductor chips, aiming to bolster domestic production. SoftBank’s substantial investment could be interpreted as a counter-move, signaling confidence in Intel’s ability to compete in this increasingly complex global landscape. The long-term implications of this strategic partnership remain to be seen, but it undoubtedly marks a significant development in the semiconductor industry.

Leave a Comment